Get Funded by For Traders

Flexible funding programs with instant funding available.

Passed your prop firm challenge? Congrats — but you're not safe yet.

In the wild world of proprietary trading firms, some red flags only show up after you've handed over your money.

Let’s break down what to watch for — BEFORE it's too late.

1. Surprise Rule Changes

Some firms love moving the goalposts.

New daily drawdown limits. Unexpected trading restrictions. Suddenly you’re breaking rules you didn’t even know existed.

Real Case:

Alpha Capital traders in 2025 reported new daily loss limits added without warning — wiping out many funded accounts overnight.

Always screenshot the firm’s rules at signup.

2. Delayed or Stuck Payouts

The #1 nightmare for traders.

Typical excuses:

- "Compliance checks"

- "Payment provider upgrades"

- "AML verification delays"

Real Case:

MyFundedFx saw waves of payout complaints in early 2025 after being acquired by The Funded Trader. Some traders waited over 30 days for their funds.

Source: [Reddit / ForexPeaceArmy Threads]

3. Vague or Unrealistic Scaling Plans

“Get funded up to $1M!”

Sounds amazing... until you read the fine print.

Scaling conditions are often near impossible.

Look for clear, written scaling rules — not just marketing hype.

4. Hidden Trading Restrictions

Some firms have insane rules buried deep in their T&Cs.

Common traps:

- No trading during news

- No hedging

- Max lot size limits

- No copy trading

- No weekend holding

Real Case:

Bespoke Funding faced trader complaints over unexpected trading condition restrictions mid-challenge.

5. Shady Firms Are Just Rebranded Brokers

Many failed prop firms weren’t giving traders real capital — just demo environments funded by challenge fees.

Warning signs:

- No info on liquidity providers

- Anonymous founders

- Super new website/domain

6. Fake Reviews Flooding Trustpilot

Some firms use "invited reviews" to hide bad feedback.

Red flags:

- Mostly 5-star invited reviews

- Generic copy-paste responses

- No real trader details

Always read the 1-star reviews for the real tea.

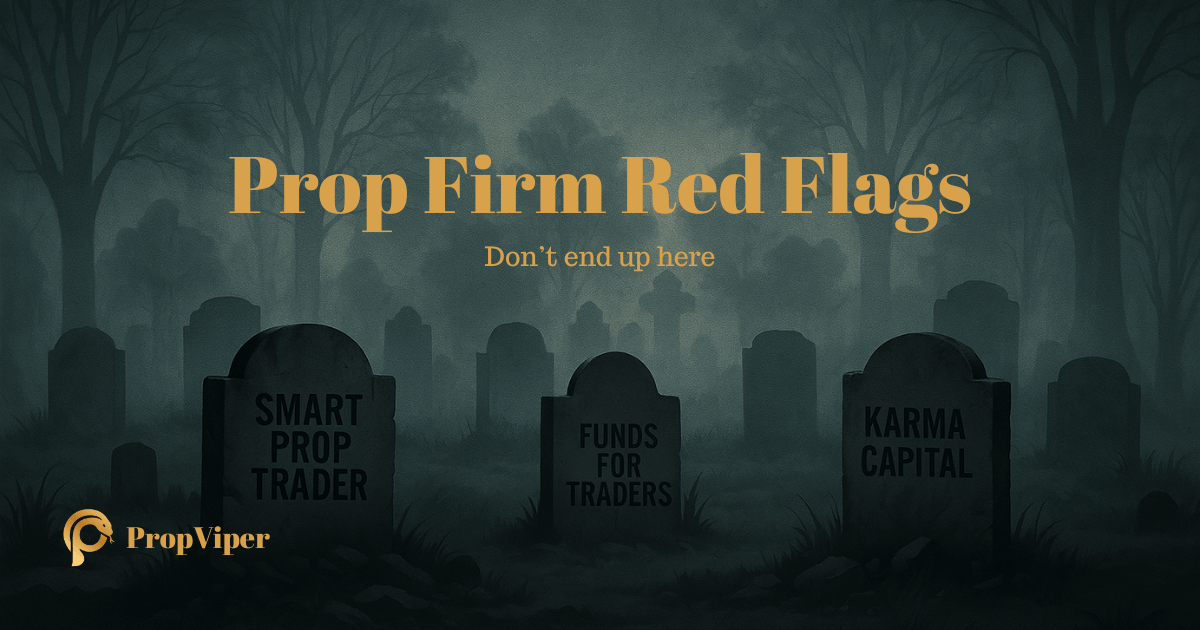

7. The 2024 Prop Firm Mass Extinction

In 2024, the prop firm industry went through a full blown apocalypse.

Between 80 and 100 prop firms shut down globally.

Why?

MetaQuotes (creator of MT4 & MT5) revoked licenses from many shady operators — leaving firms without a trading platform overnight.

Source: Finance Magnates

Firms that didn’t survive:

- Smart Prop Trader

- Funds For Traders

- Karma Capital

Final Thoughts

Trading with prop firms can unlock amazing opportunities — but only if you pick the right one.

Want to avoid the scams?

→ Compare Trusted Prop Firms Here

Save money. Trade smart. Get funded the right way.

Stay sharp, traders.

PropViper out.

Related Articles

Ukraine-Russia Ceasefire Talks Stall Amid Drone Strikes: What Traders Should Know

The latest round of Ukraine-Russia peace talks ended without a ceasefire. Instead, renewed drone attacks and prisoner exchanges dominated the headlines. Here’s what traders need to know.

Elon Musk Leaves DC: What It Means for Traders

Elon Musk’s Oval Office send-off was more than a political spectacle—it’s a lesson in billionaire power, market sentiment, and how narrative shapes trading opportunity—including in crypto.

FXIFY Discount: Save Up to 30% on All Challenges

Save up to 30% on all FXIFY challenges. Limited time offer - don't miss out!